Frequently Asked Questions

We're here to help but whilst you're waiting, please see some of our FAQ's below.

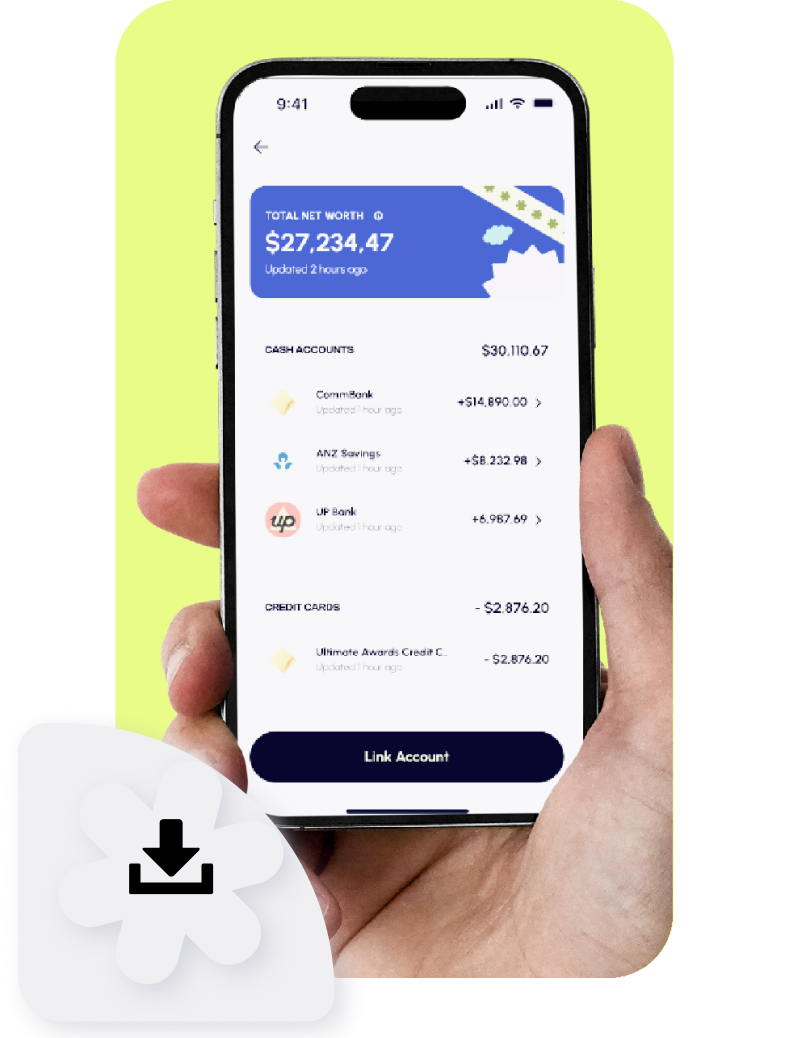

What is Spendi? Spendi is a revolutionary gamified fintech app that links your everyday transactional banking with lottery. Without changing the way you shop or pay for things, securely link your bank accounts with an approved CDR provider and your next spend could be your next win!

Is Spendi an Australian Company? Yes. 100% Australian owed and operated.

I’m having issues onboarding, what can I do? To successfully onboard, you must:

- Create an account

- Verify either your email address or mobile number with a OTP

- Create your profile with basic contact information

- Securely link your bank accounts through Open Banking

- Verify the bank accounts belong to you

- Nominate an account for us to pay your winnings into

- Select your membership

If you’re having issues onboarding, please download a copy of our onboarding guide here.

If you’re still experiencing issues, please contact us at contact@spendi.com.au.

How long has Spendi been established? Officially founded on 21st September 2023 and after years in development Spendi officially launched on 16th December 2024.

How do I win prizes? By securely linking your bank accounts and just by shopping and spending like you normally would all your transactions are automatically entered into Spendi’s draws.

Spendi’s Daily Draw goes off every night at 8.00pm AEST where multiple people are randomly selected to win back up to double the value of their transaction(s). Spendi’s Major Draw goes off every Sunday at 8.30pm where multiple winners could win a major cash prize.

Winners are notified in the app and by email and your winnings are transferred to your nominated winnings account the next business day.

How long does it take to get my funds? Spendi process winning payments the following business day and it should arrive in your bank account within 48 hours, in some cases, such as public holidays this may take longer.

How are the winners selected? Spendi has developed a propietry generator that randomly selects winners for all draws. Each transaction has the relevant number of entries that is assigned to it and each of those entries has an equal number of chances.

What are the chances of winning? With the chances of winning changing frequently, as of 3rd January 2025 Spendi has paid out more individual prizes than Premium users on the app. At average prize value of $49.66, with 49% of Spendi’s Premium users winning at least one prize and 15% winning more than once.

How long does it take for my transactions to appear in the app? Spendi automatically updates pending transactions throughout the day and a transaction should first appear in the app as ‘Pending’ within 15-30 minutes of making it.

Most banks will typically hold a transaction as ‘Pending’ for 24-48 business hours, in some cases longer. Spendi checks with your bank for updated ‘Posted’ transactions once per day and your transaction should appear as ‘Posted’ in the app within 24 business hours.

In the event that you have purchased from a partner as instructed on how to shop with that partner in the app, this transaction will remain in a ‘Pending’ status until such time as it has gone through any necessary returns period and the partner has notified Spendi that the transaction has cleared.

Once Spendi recieves a posted transaction, we will issue it with the appropirate amount of entries and the transaction will be entered into the next draw(s). You’ll recieve a notification confirming this.

What is Open Banking or Consumer Data Right (CDR)? Open Banking is an Australian Government initiative that allows you to securely share your banking data with trusted providers like Spendi. It’s completely optional and puts you in control – you decide who can access your information, what they can see, and when to stop sharing it.

To ensure satisfactory levels are met for open banking providers, the Australia Competition & Consumer Commision (ACCC) monitors the program and approves authorised representatives.

To be an authorised representative you must demonstrate that you comply with CDR legislation by providing the relevent certification to handle CDR data. As on-going compliance, authorised representatives must continue to demonstrate their compliance by independent auditing processes. For more information please visit www.spendi.com.au/open-banking.

How secure is my data with Spendi? We know security is a top concern, and it should be. That’s why Open Banking is built on bank-grade security standards and strict government regulations under the Consumer Data Right (CDR).

Here’s how it protects you:

- Bank-level encryption keeps your data safe during transfers.

- No passwords stored—we never see or save your login details.

- Government oversight ensures only accredited providers like Spendi can access your data (and yes, Spendi ticks all the boxes).

- Full control—you choose what to share, and you can revoke access anytime.

Join Spendi today and start turning everyday spending up to 300% cashback rewards, prizes, and savings—all while keeping your data safe, secure, and in your control.